Real estate investment is a fast-paced realm where opportunities can swiftly materialize or vanish. Consequently, effective marketing is paramount in communicating the potential of a property to potential investors. One pivotal material is the offering memorandum, which lays the groundwork for decisions and fostering trust among parties. What is this document, and why is a well-structured template indispensable for commercial real estate professionals like you?

What Is an Offering Memorandum (OM)?

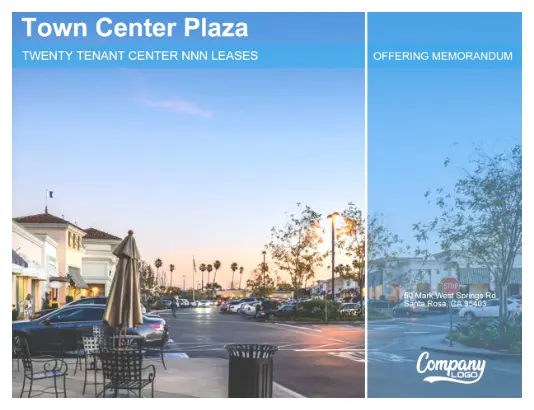

An offering memorandum (OM) is a comprehensive document that presents a real estate investment opportunity to investors, lenders, and other stakeholders. It outlines critical property details, financials, and all the possibilities associated with acquiring or developing a property. Ultimately, an OM is a marketing tool and due diligence resource that informs and persuades.

The Components of an Effective OM

The effectiveness of an OM hinges on how well it delivers key information and addresses investor concerns. A compelling IM is clear, data-driven, and strategically designed to highlight the property’s best aspects while mitigating potential risks. Here are five vital components involved.

Executive Summary

The executive summary is the first impression of the investment opportunity. This section should provide a high-level overview of the deal, summing up the most crucial details in a concise yet gripping manner.

A strong executive summary briefly describes the property’s location, size, and type. The summary should also cite the total investment amount and funding requirements, as well as the expected returns, such as cap rates or IRR (Internal Rate of Return). Finally, an executive summary should give a snapshot of the market opportunity and unique selling points.

Property Overview

A property overview follows the executive summary to break down the asset. This section should help the investors understand what they are investing in. As such, the overview discusses the property type, whether retail, office, industrial, mixed-use or another category, and also elaborates on the address, neighborhood, nearby infrastructure, and accessibility.

After the broader context, zoom into building specifications. Share the square footage, number of units, construction quality, zoning, and entitlements. If applicable, provide current tenant facts, from occupancy rates to lease terms and rental income.

Market Analysis

A market analysis reinforces the investment’s viability by laying out data-driven insights into market conditions and demand. Investors want to know if the property is well-positioned for success, so bring up local real estate trends. Tell them about rising demand, rental growth rates, and vacancy trends. Dive into comparable properties, including sales, rental, and absorption rates.

Market analysis also comment on economic drivers. For instance, job and population growth are strong indicators of a thriving market. Infrastructure developments could also make an impact. Lastly, they exhibit the competitive landscape, answering questions like “Who are the main competitors?” and “What differentiates this property?”

Financial Projections

Investors rely on financial projections to evaluate an investment’s profitability and risk. For this section, unveil projected income and expenses. Dive into rent roll, operating costs, and net operating income, and craft pro forma financial statements, such as five to ten-year revenue forecasts.

Financial projections should also classify monthly and annual cash flows. To showcase potential returns, bring expected ROI, IRR, and cap rate to the table.

Exit Strategy

A well-defined exit strategy assures investors by outlining how and when they can realize their returns. Let them know about potential sale scenarios, from who the likely buyers will be to the projected sales price.

Have a timeline for exit; for short-term flip investments, the strategy could be selling within a year or two, while for long-term hold investments, it could be holding onto the property for five to ten years before selling. Provide alternative strategies as well, which could be refinancing, portfolio integration, or REIT acquisition.

Why You Need a Real Estate OM Template

You cannot create an OM overnight; it demands extensive research, precise data gathering, and constructive writing. Given its complexity and importance, having a well-structured real estate offering memorandum template significantly streamlines the process.

A real estate OM template is a pre-designed document framework with a standardized structure. These templates are widely available on real estate marketing platforms, promising the following advantages.

Effort and Time-Saving

Manually creating an IM from scratch for every investment opportunity is time-consuming and laborious. Rather than reformatting and restructuring documents, leverage a ready-to-use framework with all essential components already in place. Templates reduce the time you spend on document preparation and let you focus on analyzing data and engaging with investors instead.

Consistency and Professionalism

An OM reflects the credibility of the investment opportunity and your professionalism as the issuer. A template ensures consistency across all OMs, maintaining a uniform look, tone, and structure for every investment pitch. A well-designed OM template also enhances readability, keeping all sections defined so investors can easily find what they need when they need it.

Reduced Risk of Missing Critical Information

Investment decisions need hard facts, thorough analysis, and transparent data, so a poorly structured OM that lacks valuable details can raise red flags for investors. Fortunately, a template also serves as a checklist. You can use it to form a complete view of the investment opportunity and make your presentations more plausible and investor-friendly.

Improved Investor Engagement and Decision-Making

Investors review multiple deals and depend on well-organized documentation; a cluttered or confusing OM can result in lost interest. With an intuitive layout and strategic flow of information, a good template guides investors through the selling points while giving all necessary data for due diligence, allowing them to evaluate effortlessly and move forward with certainty.

Enhanced Scalability for Real Estate Firms

A scalable and repeatable IM process is necessary for firms handling multiple investments. A customizable template enables you to replicate success across different properties without reinventing the wheel. By leveraging a standardized format, teams can produce high-quality, investor-ready OMs in a fraction of the time and market properties faster and more efficiently.

CREOP: Commercial Real Estate Marketing Made Easy

A well-structured Offering Memorandum is a powerful marketing document that attracts investors and facilitates decision-making. At CREOP, our commercial real estate marketing platform empowers real estate professionals to easily construct company-branded marketing materials that lead to closed deals. Every real estate Offering Memorandum template positions you for success. Book a CREOP demo today!