Commercial Real Estate Valuation – Sales Comparison Approach

In this article we’ll discuss the importance of property valuation and specifically one method for appraisal called the sales comparison approach.

One of the biggest challenges you’ll face in the real estate industry is how to evaluate a property and establish it’s real market value. The market value of a property is a critical component for:

- Performing investment analysis

- Securing financing for your project

- Assessing property insurance and taxes

- Establishing purchase or asking price

- Determining lease price and potential income

All these major activities depend on you making the correct valuation according to the real market conditions and individual characteristics of the property.

Of course, evaluating a commercial property is not as simple and straightforward as evaluating consumer goods, appliances or cars which are produced in mass quantities and have a well known market value and depreciation curve.

Commercial properties are often substantially different than anything else on the market, which makes their evaluation that much more difficult.

Furthermore, because of their astronomical cost, as compared to any type of personal property, and even residential properties, commercial property investors have to get incredibly granular and perform detailed analysis and account for every single factor that influences the value.

You can lose 10%, heck, even 50% of the value of a car, but nobody who’s dabbling in commercial real estate would imagine simply dismissing 1% of the value of a huge trade center, which can amount to hundreds of thousands, if not millions of dollars.

Market Value vs Cost vs Price

Before we continue, there are a couple of distinctions we must make. Many people mistake value for cost or price. On many occasions, these three metrics are very similar and nearly identical, but not necessarily so.

The cost of a property is the expenditures to acquire the land and necessary permits, create a development project, purchase materials, hire manpower and equipment, and construct all buildings, infrastructure and amenities. That’s for the construction phase. Afterwards, the running cost of a property includes all insurance premiums, taxes, maintenance, scheduled improvements and repairs, management, advertising, and other operational activities.

When the project is executed well, the cost of the property should be less than its value on the open market. However, it’s reasonable to assume that inadequate planning, poor architectural design, subpar construction management can all produce an unjustifiably expensive property.

Then there is the price…sales price that is. Under normal circumstances, the sales price of a property would be very close to its real market value. In fact, the market value is most often reevaluated prior to a sale to correctly determine the sales price.

However, there are many cases where the owner is under pressure to sell and will accept a much lower price than the property is worth. Likewise, properties that have been repossessed and sold at an auction will go for a lower price, as the bank is trying to recoup their finances. Finally, property sold between relatives, business partners, or other affiliations will often see its price modified to fit the needs of both parties in the deal.

In comparison, the market value of a property is the current worth of the benefits, features and opportunities it provides for its owners. Market value is driven by demand, supply, utility and accessibility.

Why is the market value so important?

If you want to sell the property and list a price below the market value, you’re likely losing money on the sale. On the other hand, listing too high of a price will hinder the competitiveness of the property on the market and you’ll experience significant dwell times, meanwhile incurring costs to run and maintain the property.

If you’re an investor, a low market value might not secure funding for your project, while too high of a value might make your funding options uneconomical.

An elevated market value will make your insurance premium considerably larger, however insufficient value might mean your asset is not completely covered in the event of catastrophic damage.

When it comes to taxes, you’re looking for a lower market value to minimize your expenses. But be warned about artificially reducing the market value of your property. The IRS are not amused by cheap tricks and it may come back to bite you at some point in the future.

Sales Comparison Approach to Valuation

The sales comparison approach is one of the most commonly-used methods to find the real world value of a property. It uses data from comparable and recently-sold properties to build a realistic picture about the target property’s worth in the economic conditions at the moment.

The sales comparison approach is used in pretty much every industry from clothes retailers to used car dealers to commercial property investors. Of course, while the former two are mass-produced items, no two commercial properties are 100% alike. And if they were, they likely wouldn’t be constructed right next to each other and would thrive in different market conditions.

This means you can’t just check what that other shopping mall is selling for and slap the same price on yours. There are multiple adjustments needed, in order to equalize the difference between these properties and establish a realistic market value.

Criteria for a proper sales comparison approach

The sales comparison approach is a useful tool, but like all tools there’s a right and a wrong way to use it. Before you begin making your analysis, you must check if the following criteria are met to ensure your valuation is correct and realistic:

- There is an active market for this type of property – if there are only a couple of properties on the market in the entire country, you don’t have enough statistical data to properly assess and adjust all factors that drive the value. There must be at least 3-4 comparable properties in the appraisal, ideally, located close to the target property, and sold within the last 12 months.

- The local and national economy should be relatively stable – in periods of abrupt violent swings (in either direction), your evaluation can be thrown off by random spikes or dips in sales prices. Likewise, the sale of the comparable properties, used in the evaluation, should be conducted under normal market conditions.

When you’ve established the comparable properties, you want to bring all of their key parameters into a table along with your subject property. It should look similar to the example below:

| Subject | Comp 1 | Comp 2 | Comp 3 | |

| Sales Price | TBD | $3,377,000 | $2,850,000 | $5,322,000 |

| Gross building area (sq.ft.) | 34,800 | 29,500 | 31,000 | 56,000 |

| Price/sqft | TBD | $114,47 | $91,94 | $95,04 |

| Building Age | 1 year | 2 years | 6 years | 5 years |

| Time of Sale | TBD | 3 months ago | 7 months ago | 11 months ago |

| Potential Gross Income (PGI) | $469,800 | $400,000 | $260,500 | $580,000 |

| Vacancy | 5% | 3% | 4% | 7% |

| Effective Gross Income (EGI) | $446,310 | $388,000 | $250,080 | $539,400 |

| Operating Expenses | $113,100 | $120,000 | $150,000 | $214,000 |

| Net Operating Income (NOI) | $333,210 | $268,000 | $100,080 | $325,400 |

| Potential Gross Income Multiplier (PGIM) | TBD | 8.44 | 10.40 | 9.18 |

| Effective Gross Income Multiplier (EGIM) | TBD | 8.70 | 11.40 | 9.867 |

| Net Income Multiplier (NIM) aka Cap Rate | TBD | 0.079 | 0.035 | 0.061 |

For this example, our subject property has 34,800 sq.ft of rentable area, going for $13.50 per sq.ft. The operating expenses are $3.25 per sq.ft and the expected vacancy is 5%.

Adjustment Factors Used in the Sales Comparison Approach

The comparable properties are similar but not quite identical. Using their values, or even the average of their values is not good enough. In the next step, we have to account for these differences by using the adjustment factors.

Physical Features

Starting from the most obvious, what are the physical differences between your subject property and the comparables? Ideally, the properties should be similar, but they’re never truly 100% identical.

Think about the age of the building, the quality of the materials and workmanship that went into its construction. Those will dictate the long term cost of renovations, repairs, energy efficiency and other running expenses.

The design will obviously impact the desirability to tenants, shoppers, visitors and will directly influence the profitability of the building.

Furthermore, consider all features that are lacking or unique to your subject property. What’s their value and how do they impact the value of the property as a whole.

Let’s assume the following adjustments for the physical features of the comparable properties: +1%, -4%, -2%, respectively.

Other Valuable Property

What else comes bundled with the property?

If we’re talking about a hotel, then the furniture, carpets and interior decorations will represent a considerable point of value – enough to nudge the price of the entire property.

If we’re talking about industrial equipment, like manufacturing machines, it can cost many times the price of the building on it’s own.

Whenever such differences are present, there must be an adjustment to compensate for their value.

Ownership Interest

It makes a big difference whether you’re purchasing a building outright, or you’re purchasing it with tenants in situ. In the first case, you’re acquiring the fee simple interest, which gives you absolute ownership of the property.

In the latter, you’re acquiring the lease fee interest which means you become a landlord to the tenant that’s already occupying the property and have to respect their valid contract until it expires or you have a chance to terminate it. On one hand, you might not want these particular tenants, or tenants at all. On the other, you start earning revenue immediately after the sale, which can help out with your cash flow.

While evaluating, you should take note which property was sold under what conditions and account for that accordingly.

Conditions of Sale

A sale conducted under duress could force the seller to forfeit a significant sum in order to accelerate the process and close the deal. A business in decline or under the threat of bankruptcy will readily provide a discount if the funds from the sale will keep them afloat and pull them through a crisis.

Similarly, a sale between relatives or closely associated businesses could modify the price as to fit each party’s needs.

These are not considered normal sale conditions, so if such are present in your comparable properties, they must be adjusted to reflect a natural sales process.

Let’s assume that property #2 was sold under its market value, because the previous and current owner have closely connected businesses with multiple intersecting revenue streams. We’ll tag a 2% devaluation.

Market Conditions at the Time of Sale

The economic landscape is ever changing. All the comparable properties were sold in less than a year from the time of our analysis, which is desirable. However, prices can change every month and even every week.

Depending on the stability of the market which we’re considering, an adjustment must be made to account for the elapsed time from the sale of the comparable property to today.

For example, the property market has been on the rise in the past year, with average prices creeping at 0.5% per month.

This means the comparable properties must receive a bump in price with 1.5%, 3.5%, and 5.5% respectively. That’s a substantial difference worth nearly $300,000 in for property #3.

Location, Location, Location

Location is everything in commercial real estate. Prices vary wildly, between different states, counties, cities, neighbourhoods and even individual streets. Transport links, the quality of the local infrastructure, amount of traffic, competition, quality of life and average income of nearby residents, and many more factors play a crucial role in determining the profitability and therefore the value of a given commercial real estate.

Therefore, the locational differences must absolutely be accounted for, as that can dramatically change the perspective of your evaluation.

Of course, this task requires its own study, so we’ll keep it out of our example. But you don’t want to skip on this step during your own appraisal.

Putting it All Together

After analysing each adjustment factor, it’s time to present the corresponding adjustments in a table.

| Comp 1 | Comp 2 | Comp 3 | |

| Price/sqft | $114,47 | $91,94 | $95,04 |

| Physical features | 1% | -4% | -2% |

| Conditions of sale | 0 | 2% | 0 |

| Market conditions at the time of sale | 1.5% | 3.5% | 5.5% |

| Total Adjustments | 2.5% | 1.5% | 3.5% |

| Adjusted Price/sqft | $117,33 | $93.31 | $98.37 |

| Adjusted value | $3,461,425 | $2,892,750 | $5,508,270 |

| Adjusted PGIM | 8.65 | 11.10 | 9.50 |

| Adjusted EGIM | 8.92 | 11.57 | 10.21 |

| Adjusted Cap Rate | 0.077 | 0.035 | 0.059 |

As you can see, we have some significant movement in the values, compared to the original table.

With these values we can average the market multipliers for all comparables and project the estimated value of our subject property.

| Value based on PGIM | Value based on PGIM | Value based on PGIM | |

| Sales Price | $4,580,550 | $4,565,750 | $5,845,790 |

| Potential Gross Income (PGI) | $469,800 | $469,800 | $469,800 |

| Effective Gross Income (EGI) | $446,310 | $446,310 | $446,310 |

| Net Operating Income (NOI) | $333,210 | $333,210 | $333,210 |

| Potential Gross Income Multiplier (PGIM) | 9.75 | 9.72 | 12.44 |

| Effective Gross Income Multiplier (EGIM) | 10.26 | 10.23 | 13.09 |

| Net Income Multiplier (NIM) aka Cap Rate | 7.27% | 7.29% | 5.70% |

Finally, our subject property value estimate ranges between $4,565,750 and $5,845,790.

Conclusion

To summarize: The sales comparison approach uses recent sales data from similar properties, which is adjusted and processed to estimate the realistic market value of your subject property.

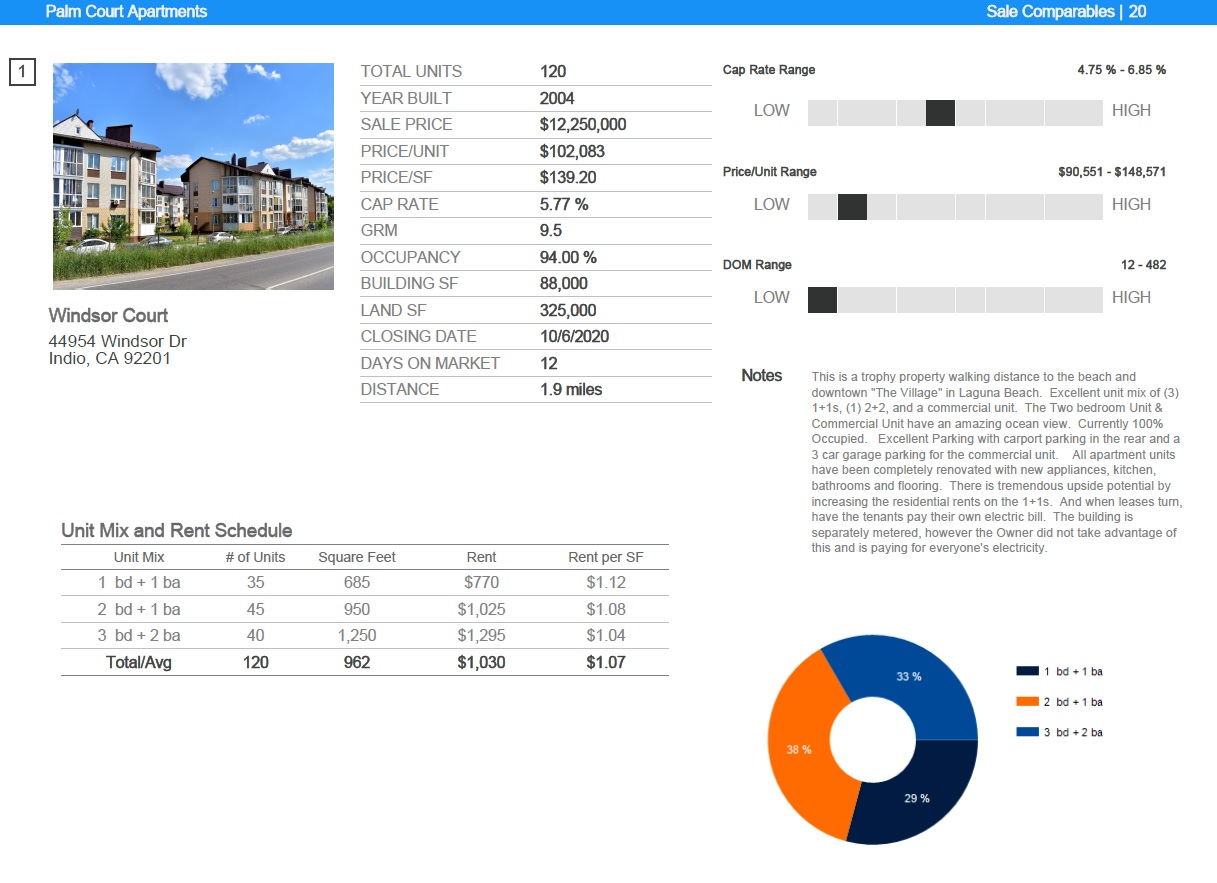

That said it is not an exact science. In a real world situation, you’ll have to work with many more factors and variables than we discussed in this article. A great number of them will be adjusted subjectively, based on the data you can collect and a fair amount of assumptions and interpolations. The comparables analysis used in CREOP’s platform helps illustrate the main financial metrics used when evaluating comparable properties.

Therefore, you will never get a single number that’s the absolute true market value. A range of values provides you with a perspective on how your property might move on the market.

Finally, remember that even though you’ve calculated a market value for your property, you’re not guaranteed to sell or buy at that price. The market price is set by the highest sum a buyer (who has the means to complete the transaction) is willing to pay for said property.