It is estimated that there are 109 million people, or 36% of the population, currently renting in America. And this only accounts for residential properties. When it comes to commercial buildings, there are well over 5.5 million spanning the country. And you can bet a lot of them are being leased.

Needless to say, there is a lot of opportunity available for investors of all kinds to build a successful real estate business.

Investors in the market looking to expand their commercial building portfolios are always on the hunt for the best deals and the most profitability. However, determining whether a potential investment property is a good one or not takes some know-how.

If you’re an investor looking to build a bigger portfolio with properties that have a high ROI and tenants willing to pay premium prices, you’re going to need a quick way to vet, compare, and analyze potential listings. That’s why today we’re going to teach you about one of the best resources investors rely on to gauge the value and profitability of potential investment properties: gross rent multiplier – A.K.A. gross income multiplier (GIM).

What is Gross Rent Multiplier?

Gross rent multiplier (GRM) is a calculation used by real estate investors to determine the value and estimated profitability of a property before taking the plunge and buying.

Experienced investors always have a plate full of potential properties they’re considering when trying to build their portfolio. But prioritizing which ones to invest more time and resources into for analysis quickly becomes difficult, especially if the properties are not exactly comparable, as is often seen with commercial properties. That’s where calculating the gross rent multiplier comes in handy.

Why Gross Rent Multiplier is Important

It’s not enough to know that the gross rent multiplier is useful in determining the potential profitability of an investment property.

A successful investor will understand why calculating this value, as opposed to others, is so important, especially in the beginning stages of purchasing:

- Quickly and efficiently decide which properties are worth your time analyzing further

- Compare properties that are similar and determine which ones stand to generate the most annual revenue

- Buy the right property at the right time, regardless of the status of the housing market using gross rental income values in your calculation

- Avoid falling victim to the versatile housing market by using fair market value to determine potential annual rental income – use GRM instead

- Easily convince lenders of your ability to repay a loan upon approval

- Determine how the property’s condition and possible rent rate compare to the competition

- As a commercial investor, easily differentiate between very different properties and let the numbers guide your efforts

- GRM / GIM is a more pure metric compared to cap rate as there is less room for error by the Broker or Seller.

Of course, there is no magic formula that will guarantee what a potential investment property will yield the first year or any year thereafter. The point of calculating the gross rent multiplier is to quickly weed out properties you know will not be profitable and focus your attention on those you are seriously considering investing in.

How to Calculate Gross Rent Multiplier

Gross rent multiplier is a mathematical formula used to calculate an investment property’s potential rent income based on the ratio of the property’s fair value market (or purchase price) to the expected gross annual rent income.

In other words, to calculate the gross rent multiplier of any property, you have to have a value assigned to the property and know the amount of rent you can expect to collect each year from it.

You can get the GRM for an investment property using the following equation:

Market Value (or purchase price)/ Annual Gross Rental Income = Gross Rent Multiplier

Let’s say you want to purchase an investment property listed at $300,000 and you know the annual gross rental income is $30,000. Calculating the GRM would look like this:

$300,000/$30,000 = 10.0 GRM

Of course, this means nothing to you right now; it’s just a number. However, if you were to take a comparable property, also listed for $300,000, but with an expected annual gross rental income of only $25,000, you would now have a GRM of $300,000/$25,000 = 12.0 GRM.

Comparing the two example properties, you now realize that you stand to make much more money with the first property as opposed to the second based on the gross rent multiplier. In fact, the lower the gross rent multiplier, the higher the likelihood that the property will yield more profit.

Of course, the gross rent multiplier does not account for things like:

- Cost of vacancies

- Annual taxes

- HOA fees

- Insurance

- Maintenance and repairs

- Utilities you cover

Remember, GRM relies solely on the gross annual income. To really determine whether an investment property is worth your time and money, you’ll have to do more research.

Want to take a potential property’s GRM and estimate the market value? Simply use this formula:

GRM x Annual Gross Rental Income = Approximately Value Market

What a GRM is Not

Gross rent multiplier is an excellent tool for quickly comparing properties and gauging whether you should continue your research or not.

That said, GRM is not the end all calculation you should use to make an investment decision. Many other factors play into the profitability of a property that go far beyond the expected annual gross income.

In addition, the gross rent multiplier is not a calculation that should be used to determine the time it will take for you to pay off an investment property. Unfortunately, many investors are misinformed and are led to believe that if a property has a GRM of 10.0 that means it will take approximately 10 years to pay off the property in full and begin generating nothing but profit.

The problem with this thinking is that the gross rent multiplier does not take into account any other expenses related to a property that an investor will be in charge of. Not to mention, the gross rent income is an estimate, not a surefire number that will remain static over time. All of these things have the potential to play into how long it takes you to pay off your investment property and begin generating pure profit.

Want to get an idea how much the related costs of owning an investment property might be each year? Choose one of the following to get an idea:

- 1% of the purchase price of the property

- $1 per square foot of the property

Knowing this information and the GRM will give you a better idea how much profit you stand to gain from an investment property each year.

Wrapping Up

In the end, all real estate investments come with a certain level of risk, no matter which calculations you use to make a final purchasing decision. That said, the gross rent multiplier of a property is an excellent tool to have on hand for quickly vetting and comparing properties so you can focus your efforts on properties that are likely to generate you the kind of annual income you want.

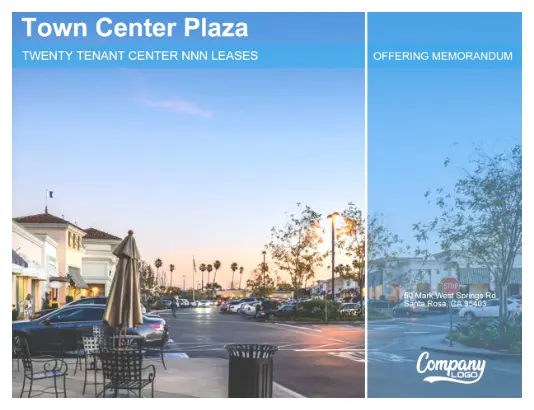

Have you recently purchased a prime piece of commercial real estate and want to advertise it as available? Take advantage of our comprehensive commercial real estate online publisher (CREOP) tool.

Simply input the details of your property and let the CREOP software crunch all the numbers and generate a professional looking marketing package that you can quickly email or print and deliver to clients and brokers. Get in touch with us today and let us help you get started with advertising your prime piece of real estate.