Top Commercial Real Estate Marketing Software

Just like in any other industry, real estate success starts with marketing. Making use of all the different techniques and innovative solutions from the digital marketing space will certainly increase your chances of finding more clients and quickly and efficiently selling properties or helping your customers acquire them.

So regardless of whether you’re searching for new properties for investment or new tenants for a client, we’ve prepared a list of top real estate marketing software that can help you boost your performance and achieve better results. In this article, we’ll look at the following commercial real estate marketing tools:

- Commercial Real Estate Online Publishing Tools

- Marketing Operations Tools

- Commercial Listings Platforms

- Content Marketing Software

- Lead Generation & Prospecting Tools

- Marketing Analysis Software

- Paid Advertising Tools

Let’s see what some of the most popular and efficient choices from these categories are.

Commercial Real Estate Online Publishing Tools

CREOP

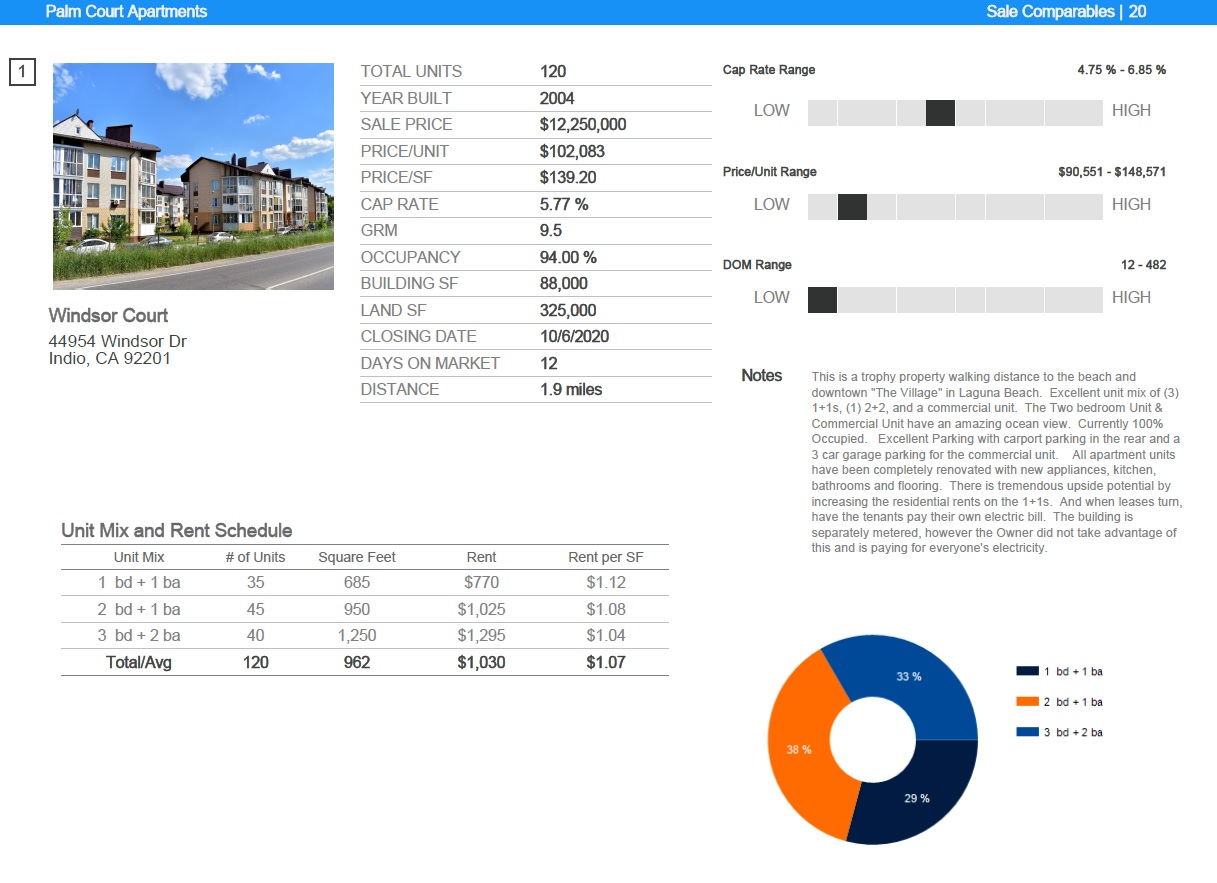

CREOP is a commercial real estate online publishing tool that enables users to create offering memorandums, proposals, and property websites using expert and bespoke designs. It offers an efficient way to attract investors to commercial properties via professional presentations that offer valuable and complete insights.

This tool is ideal for making a great first impression and to make any property stand out from the rest. CREOP will help you keep your data organized and easy to access as it stores all numbers and statistics available to use in the property presentation. You can use your brand logo and colors, enter the property features, financials and images and the highly intelligent software will package everything together for you, automatically generating the charts, graphs, tables, designs, financial analysis, and more. What may take 30 minutes to complete, will look like it took days.

Marketing Operations Tools

MREN

MREN stands for Metis Real Estate Network and is a technology-enhanced collaboration platform that aims to support and help professionals in networking while they work. Some of the top features that the tool offers include interconnected networks, internal communication, collaboration tools, and more.

In addition, you can benefit from its marketplace that supports syndication and capital raises. Its exceptional document management feature, on the other hand, ensures safe and flexible document distribution.

Apto

Apto is a commercial real estate software company and the number one CRM and deal management platform for brokers in the space. It’s popular as the software with the most paid users when compared to other services in the industry.

With the use of Apto, CRE brokers can manage their contacts, properties, listings, and deals across different locations and devices. It can also calculate commission splits between brokers and can manage workflows.

SharpLaunch

SharpLaunch is a commercial real estate marketing platform that offers all you could ask for. You can use it to streamline marketing activities, maximize speed by reducing time spent on administrative and marketing production activities, improve asset visibility, and more.

You can use the tool to see which leads are viewing specific content provided by you. Additional features include personalized interactive maps, document portals, email marketing, and others.

RealHound

RealHound is a CRM solution that was created to help franchise owners, small business owners, property owners, managers, and business professionals. It’s a common tool used by professionals in the commercial real estate environment.

Unlike other, standard apps, RealHound offers the opportunity of connecting people and properties by showing listed properties on a map. You can also take advantage of its email and text templates that are quick and easy to use.

Commercial Listings Platforms

Without a listings platform, commercial real estate marketing wouldn’t be possible. There are a ton of listings platforms that you could try but we’re about to introduce you to the most popular ones:

42Floors

42Floors is one of the popular and easy to use national search engines that offer a diverse range of listings. It offers a range of images, downloadable flyers, floor plans for investors, tenants, and brokers to use in order to make the right decisions. It’s an extremely well-known platform and holds positions on Google’s first page in 200 US cities.

You can easily upload a listing on the platform and make any commercial property easily discoverable.

Commercial Search

You can use Commercial Search for free and add it to your priority commercial real estate marketing tools. It’s a national listing platform that provides leases and sales for all CRE asset class types. Where Commercial Search stands out is that it attracts its own traffic and also receives a lot of traffic directed from Realtor.com, which enjoys a lot of popularity.

People can also take advantage of its broker directory, which is definitely a helpful place for commercial brokers to be active in.

CREXI

If you still haven’t heard about CREXI or the Commercial Real Estate Exchange, Inc., we highly recommend that you check it out. It’s one of the fastest-growing marketplaces in the real estate industry and provides access to advanced technology.

The data platform is committed to providing support for the CRE industry and the professionals involved. You can easily and quickly streamline, manage, and expand your business and successfully close deals with clients quicker than ever. More than 500,000 commercial properties have been leased or sold via the platform, totalling in more than $1 trillion in property value.

Brevitas

If you’re looking for an exclusive place for buying and selling commercial real estate assets, Brevitas is the answer. With an international presence and popularity, Brevitas is a marketplace for the acquisition and disposition of commercial real estate assets.

It’s also the perfect place to establish useful and long-term relationships in key markets where your presence is essential.

Catylist

Catalyst is available in more than 50 national markets and offers broker-loaded and thoroughly researched databases of commercial real estate. Its users enjoy access to analytics, personalized reporting, broadcast email opportunities, listing search, broker website display, and more.

It’s a tool that is predominantly used in North America for the exchange of information and research and to prospect and do business.

Digsy

Digsy’s main mission is to make the search for commercial space easier and less stressful. It’s a free commercial real estate listing service created for tenants and buyers looking for their next commercial property.

The platform makes the connection between brokers and tenants and buyers so that business can quickly be done and the needs of every client can be satisfied.

Total Commercial

With years of experience, Total Commercial has provided commercial real estate listing information since 1995. It’s a full-featured commercial real estate listing service that is national but very popular in Florida.

Users can take advantage of unlimited listings against an annual fee. However, real estate agents can create customized pages in their professional database free of charge. The listings are carefully inspected and checked before approval.

CoStar

CoStar stands out as the biggest provider of commercial real estate research and data. It’s the go-to place for real estate professionals as it offers the most comprehensive listings database that includes properties, comps, contacts, analytics, market reports, news, and more.

The company has invested more than $1 billion in the development of a sophisticated research operation to back its platform. Today, more than 80% of commercial real estate transactions happen with a CoStar user and subscriber.

Content Marketing Software

Content marketing tools offer a lot of advantages in the commercial real estate space. They can help you create and execute a better content marketing strategy and ultimately – enjoy more converted users into clients.

Canva

Even though you may be involved in the commercial real estate industry instead of graphic design, your content marketing efforts are likely to require some level of graphic design. Thankfully, tools like Canva make thighs easier even for the most inexperienced person.

You can create your own personalized flyers, E-books, newsletters, social media posts, and more. It’s a platform that offers a range of solutions that only require a click of a button. It will improve your digital branding and will attract more users to learn more about what you have to say.

Hemingway

The Hemingway App is designed to turn ordinary content into amazing content. It helps you transform your writing through valuable tips and suggestions for improvement.

For example, long and complex sentences can be turned into easy to read, short messages. Grammar and spelling errors will also be detected and suggested for improvement. If you spend a lot of time creating blog post articles, emails, or other types of content, Hemingway can be a true saviour.

Grammarly

Most content writers find it difficult to imagine what life would be without Grammarly. It’s an amazing tool that is designed to check your grammar and spelling on any piece of content that you use it for. However, it offers more than that.

Grammarly can analyze your voice, sentence structure, checks for plagiarism, and more. There’s an available extension for Chrome and you can use it for any marketing channel that you create content for.

Buildout

Specifically created for the commercial real estate space, Buildout allows you to automatically populate targeted marketing materials by using your company or brand’s blueprints. It offers invaluable support in expanding your existing marketing reach and ongoing content creation efforts.

You can also enjoy the process of a streamlined listing as an advantageous feature that the tool provides.

Typeform

By using Typeform, you are basically creating a step-by-step process to engage and quality the visitors that reach your website. The main objective of the tools is to boost the conversion rate of your inbound traffic and lead efforts.

The tool is the perfect way to grab real estate leads in a conversational and gentle method.

Medium

Medium is a great tool that can be exploited by experts in the commercial real estate industry. It offers a user-generated content community of content. It can be used entirely instead of a personal blog and can point to your domain.

The platform offers a range of pre-built aesthetics that will reduce the time necessary to format and design your content. You can use it to get your content seen by a wide audience, helping you get your name recognized and potentially connect to prospects.

Quora

Regardless of your niche, Quora is the place to be. CRE is no exception. The site is created on the basis of question and answer and connects users to providers of services, products or simply knowledgeable experts who can offer insights and answers on specific topics.

Some of the relevant channels for CRE include ‘Commercial Real Estate’, ‘Commercial Real Estate Marketing’ and ‘Commercial Real Estate Finance.’ Join the channels and provide answers to the questions potential clients have.

Reddit

Reddit is another community that you absolutely want to be active in. It’s among the strongest online communities where users communicate and exchange information on merely any topic you could possibly imagine. You can contribute with images, text posts, links to sites, and more.

Each subreddit on the platform could be regarded as a separate forum where individuals with shared interests are active. You can browse to find CRE-related subreddits and engage with users.

Lead Generation & Prospecting Tools

LinkedIn Sales navigator

LinkedIn Sales Navigator is certainly not limited to the real estate industry but it could dramatically improve your lead generation activities. It allows you to perform specific searches using the lead builder tool to match specific experts or individuals from certain professional backgrounds or locations.

When you find the filters that work for you, save them for later and target your audience with personalized marketing campaigns for maximum results.

Ninja Outreach

Ninja Outreach is an influencer marketing and blogger outreach software that automates outreach to influencers and the process of lead generation, saving you time and energy. By using this tool, you can create exceptional, highly customized marketing campaigns.

Discover business profiles and influencers on social media in your chosen niche and geographic location using keywords. This is a great solution for extending your reach to a specific target audience and enjoy more traffic for your commercial real estate business.

Reonomy

Reonomy offers the biggest commercial real estate owner database in America. By using the platform, you can discover LLCs and privately-owned properties that are not being advertised on the market yet.

You can enjoy access to property ownership details like phone numbers, email, mailing address, and more. With this valuable and hard to find information, you’ll always be one step ahead of the competition. The platform is unique with the filters provided that guarantee that you target specific leads only.

Google Advanced Search

Wouldn’t it be helpful if you could build a list of listings that are no longer advertised and have recently expired? Google Advanced Search offers exactly that.

Tapping into expired listings is an amazing opportunity for commercial real estate brokers to access information about a seller who hasn’t yet sold their property. All you have to do is choose a listings platform and perform a search for expired listings on it.

Marketing Analysis Software

In order to make your commercial real estate efforts effective and successful, it’s essential to combine them with analysis and make ongoing improvements. To do this, you need data and ways to quickly and efficiently analyze it.

Here are some of the top tools that can help you do this:

Cherre

Cherre is a platform that allows you to connect your real estate data and make it visible for the whole organization in order to support better investment decisions and more efficient underwriting.

You can enjoy a full view of your entire portfolio from one place, take advantage of useful filters by location, asset class, and more. The platform also offers the ability to create reports, monitor benchmarks, and improve performance.

Google Analytics

Although not created to suit the purpose of commercial real estate alone, Google Analytics is an incredible tool that can be used by real estate professionals. It’s one of the most reliable tools for tracking your marketing activities.

The majority of CRE experts benefit from information on where traffic to their website came from, which allows them to identify which channels are performing best and where most clients are coming from.

FullStory

Do you want to know what people do when they’ve landed on your website? FullStory offers the chance to replay user sessions on your site and can provide invaluable information that can show you which areas need improvement and where most visitors are focusing their attention.

It will quickly show what changes you need to make to convert more users into clients and help them find or sell their commercial property.

UTM Generator

By using UTM tracking, you can create a bespoke URL that you can use to determine where your website traffic is coming from.

It’s helpful in monitoring the performance of different campaigns and content. When you’ve created your custom-made URL, visit Google Analytics and go to the Acquisitions Section to see the traffic assigned to this link from certain marketing channels.

Google Search Console

You don’t have to be a marketing expert to use Google Search Console. It’s a useful Google tool that offers useful information that will help you understand your clients better. It shows what keywords users search for before landing on your website, which can be helpful in creating content that converts better.

It’s also a great way to determine whether you are attracting the right audience to your website. You can see the links that lead to your site and other valuable insights that can help you improve your commercial real estate marketing strategy.

Google PageSpeed Insights

PageSpeed Insights is another Google tool that is extremely useful in improving your website’s performance and making the user experience better, which increases your chances of converting them into a client.

The tool enables you to inspect your website’s speed on mobile and desktop. You will also receive suggestions on how you can optimize the performance by making the necessary changes. Optimizing your page load speed can help you rank higher on search engine result pages and become more visible for clients.

Optimizely

Another useful marketing tool, Optimizely lets you run A/B tests and experiments on your website. You can use a range of dynamic or basic features to inspect your website and test how it performs in certain scenarios

This will help you validate conversion rate optimization and will help you understand whether your existing landing pages are good enough to help convert users into clients.

Paid Advertising Tools

Paid media is any performance-based medium like pay-per-click, remarketing, paid promotions, keyword campaigns, banner ads, and more. Paid advertising tools offer quick and efficient ways to improve your results and attract more clients as a commercial real estate professional.

Here are some of the main tools you need to be aware of:

Google Ads

Google Ads is the most powerful network for digital paid advertising worldwide. Unlike paid ads on social media channels, Google Ads allows you to bid to place your ad as the top result for specific searches based on keywords. It’s an extremely effective way to get your name seen by a vast range of users searching for services like yours.

Considering that more than 60% of core search queries in the United States are generated by Google, showing up on the first page is definitely something you want to invest in. It’s also interesting to note that the average cost-per-click or CPC in the real estate industry is $2.37, while the most expensive real estate industry keyword is $95.

Bing Ads

Similarly to Google Ads, Bing Ads are created to help brands get noticed on Bings’ search results pages. Although Bing does not have the exceptional numbers of Google, it’s still a platform that a lot of people rely on for information.

With one Bing ad buy, you can reach more than 160 million unique searches via Microsoft and Yahoo sites, which are 30% of total search engine share and more than 6 billion monthly searches.

Facebook Ads

If you’re looking for an affordable and reliable way to reach and market to commercial real estate professionals or potential clients, Facebook Ads is another useful tool. You can create different types of campaigns and choose detailed targeting to make sure you’ll reach the perfect audience.

You can target based on interests, hobbies, geographic location, income, and more. The best part is that Facebook Ads also provides amazing ways to analyze the received data and use it for more detailed targeting in the future. With more than 2.5 billion monthly active Facebook users, there’s a lot of potential to explore on the social media platform.

Improve your CRE marketing efforts

In order to sell and achieve your goals, you undoubtedly need successful and efficient marketing strategies in the commercial real estate market. The tools that we’ve looked at in this article are some of the most popular and commonly used platforms and software that aim to help you speed less time on marketing yet enjoy better results.

To choose the tools that will work best for you, you may need to test a few options to see which ones are capable of providing all that you need.